On April 25, Twitter's board of directors announced an agreement to sell the company to Elon Musk, the world's wealthiest person, for $44 billion. That sounds like a lot of money. But Musk can afford it. One recent estimate of the Musk fortune puts his wealth at $214 billion, a sum a bit down from the more than quarter trillion he held earlier this year.

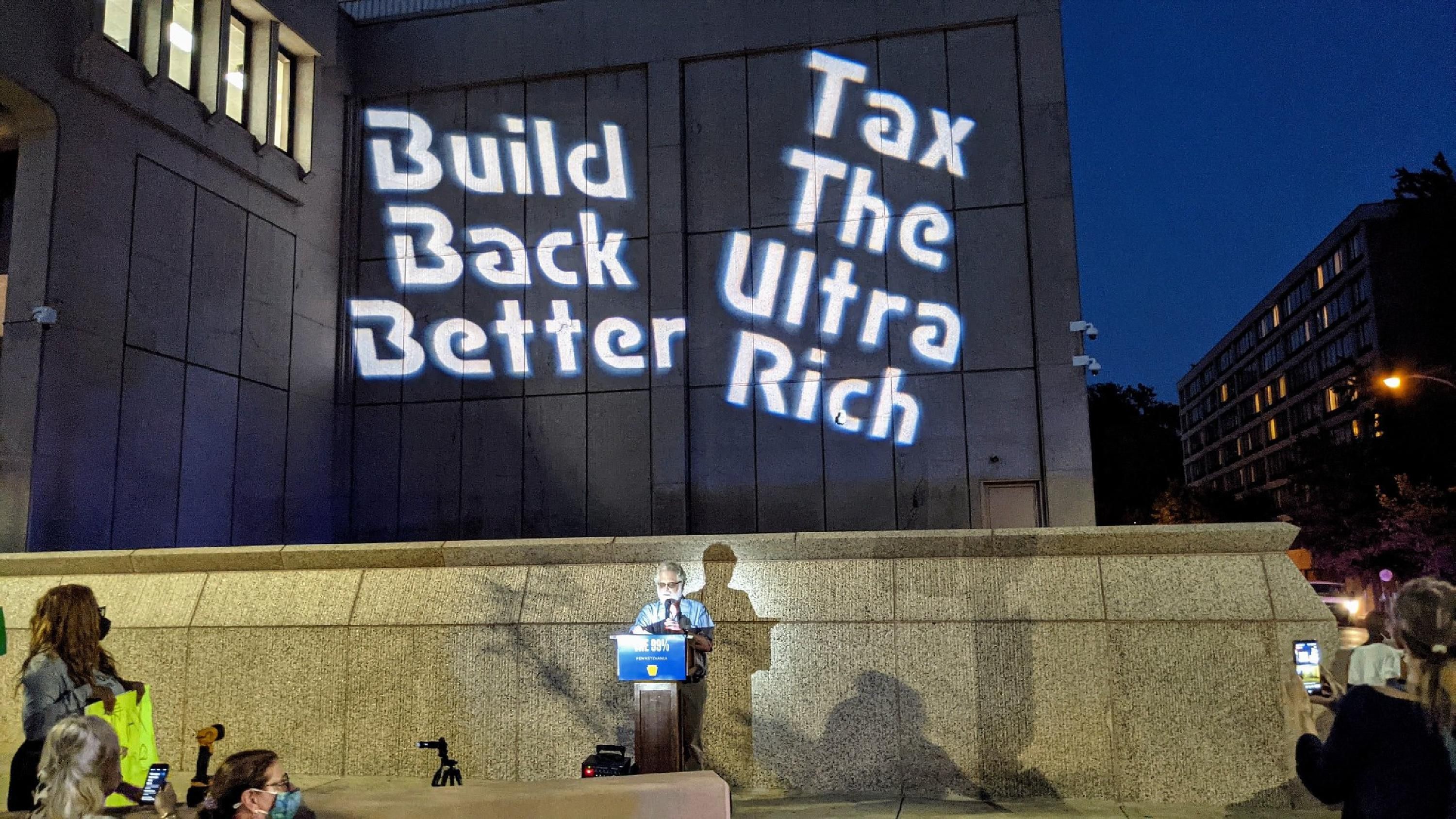

Our nation's wealthiest 10 percent now hold nearly 70 percent of our country's wealth.

Our Institute for Policy Studies colleague Chuck Collins has documented that Musk's personal wealth, over the first year and a half of the Covid pandemic, grew by an incredible 751 percent at the same time millions of American families were struggling to pay their rent and utility bills.

Unfortunately, we can't write Musk off as some sort of an anomaly. U.S. billionaires combined increased their wealth by a staggering $2.1 trillion over the first year and half of the pandemic. All those trillions could now be addressing a host of serious crises at home and internationally. Those dollars could be charting the world on a new sustainable course. Instead they're merely making the already rich phenomenally richer.

Not my fault, says Elon Musk, who loves to claim that he's doing his part—as the driving force behind the world's biggest electric-car company—to save our planet.

Should we be giving Musk the applause he feels he so richly deserves? Let's step back for a moment and take a closer look at where grand fortunes, Elon Musk, and Tesla fit into our menacing big picture.

Let's start with greenhouse gas emissions. Worldwide, these emissions have grown steadily over the last several decades. They have, to be sure, declined in the United States since their 2007 peak, but their rate of decline comes nowhere close to what we need. At the current decline rate, we'll still be emitting 3.6 billion metric tons of greenhouse gases annually in 2050. By that year, scientists tell us, we will need to have emissions down to zero.

Newly emitted quantities of carbon dioxide, a chemically stable gas, can last in the atmosphere for generations—and continue heating up our Earth for centuries. So even with declining U.S. emissions, we're doing the Earth no grand favor. Here in the United States, we already bear the responsibility for one-fifth of all global greenhouse gas emissions since 1850, more emissions than the next two highest cumulative emitters, China and Russia, combined. And we remain today one of our world's largest per capita emitters.

Overall, the huge emissions disparity between the United States and other wealthy countries and the nations of the Global South has led the United Nations to adopt the principle of "common but differentiated responsibility" as the ethical basis for determining just who needs to pay what to help our world mitigate and adapt to climate change.

This principle hasn't yet actually translated into the kind of North-South financial flows we need to see, as demonstrated by the intransigence of wealthy countries at the UN climate talks last November, particularly on questions over funding for climate change-related loss and damage. Even so, the UN's official acceptance of the principle that wealthy countries should fund climate action in the Global South as a matter of basic fairness represents a significant step forward.

This same discussion about responsibility, unfortunately, hasn't taken place at the national level here in the United States. How should we allocate the cost of climate change mitigation and adaptation among Americans? We Americans need to be addressing this question head on, even if Elon and his fellow deep pockets would rather we not.

The vast bulk of the wealth in the United States today did not exist before the Industrial Revolution. We owe our current affluence to the fossil-fueled economy that has dominated the United States ever since this Revolution began.

The gains from this economic growth have gone to a narrow share of the American people. Our nation's wealthiest 10 percent now hold nearly 70 percent of our country's wealth. Our top 1 percent holds over 32 percent of our nation's $142.18 trillion, mostly fossil fuel-generated fortune, an average of $35 million of wealth per household.

Meanwhile, the poorer half of the U.S. population owns only 2.6 percent of America's wealth.

Connect all these dots and we have a simple, straightforward story: Fossil fuels fueled the Industrial Revolution. Atmospheric carbon dioxide has increased by 50 percent since that revolution began. The economic gains from that revolution have gone to a small wealthy in-crowd. These wealthy few, from John D. Rockefeller to Elon Musk, have cornered the economic gains from our generations of fossil-fueled economic growth.

Does Elon get a pass because he's making electric cars? Hardly. For starters, Tesla cars come with an inordinately expensive price-tags. Musk relies upon fossil fuel-generated wealth to even have a market for expensive cars. Tesla, as an auto manufacturer, also benefits mightily from our nation's elaborate highway system, a key contributor to the outsized emissions our country has historically produced.

Our wealthiest Americans have benefited disproportionately from our fossil-fuel economy. It's only fair that these wealthy pay for the climate damage they've so benefited from. How could we see to it that they pay up?

First, we should close the gaping loopholes in America's estate and gift tax law. Under current statutes, America's wealthiest families sit poised to escape estate and gift tax on the coming intergenerational transfer of trillions of dollars in wealth.

According to a recent Americans for Tax Fairness report, the top 0.5 percent of our U.S. population will transfer $21 trillion of wealth to the next generation over the next 24 years. If America's wealth transfer tax system were working as intended, those wealth transfers would generate upwards of $5 trillion in tax revenue. But existing tax loopholes guarantee that Uncle Sam will realize precious little of that $5 trillion.

Second, we should replace the generation-skipping tax, or "GST" as the tax lawyers call it, with an annual excise tax on large accumulations of trust-held wealth. Lawmakers originally created the GST to keep wealthy families from sidestepping the estate tax, for one or more generations, by gifting their fortunes to their grandchildren or great-grandkids. Unfortunately, this GST is not working to recoup the estate and gift tax revenue lost to the "dynasty trusts" that now hold trillions of ultra-rich family wealth.

Third, we should subject the investment gains of the ultra-wealthy to income tax as these gains accrue—and not let these gains pile up untaxed until the assets that produce them get sold. Two proposals before Congress and a third from the Biden administration would do just that. These proposals differ in detail, but each would make avoiding taxes by holding highly-appreciated assets until death much less lucrative. Each of those proposals would also produce hundreds of billions in new tax revenue.

The revenues generated by these commonsense tax reforms would provide much-needed funding for just climate mitigation and adaptation. And having the vast fortunes created by our fossil-fueled economy become a major funding source for transitioning away from the system that generated these fortunes in the first place would be, by any measure, only fair.

This content originally appeared on Common Dreams - Breaking News & Views for the Progressive Community and was authored by Basav Sen, Bob Lord.

Basav Sen, Bob Lord | Radio Free (2022-06-27T16:24:03+00:00) Tax Extreme Wealth to Save Planet Earth. Retrieved from https://www.radiofree.org/2022/06/27/tax-extreme-wealth-to-save-planet-earth/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.