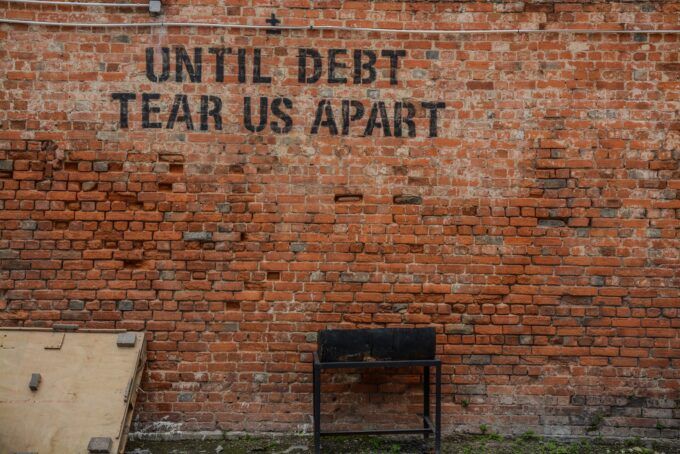

Image by Alice Pasqual.

The Transcript of My Imaginary Commencement Address at Milgram State University on the Topic of Student Debt

No doubt some will question whether I merit the honorary degree with which I’ve just now been presented. And many more of you will no doubt question whether I merit the honor of addressing this sea of exuberant young faces, given, especially, that no one invited me. But I trust that the fact that this university is entirely fictional will render my lapse in civility more forgivable.

But here I stand, poised to greet you, as you close one chapter–or at least a subsection, paragraph or clause–and embark on a fresh, new journey. One that will challenge you to open not simply your mind, and your heart, but your whole self–by which I mean, of course, your wallet.

Because, brothers and sisters–and all manner of queer kin alike–when many of you were in knee pants, you signed on the dotted line and agreed to enter into what may well be the most enduring relationship of your life. One that may well outlive your first marriage (especially given the considerable stress it will place on it), possibly both your parents, one of your siblings, and certainly a succession of furry friends with names like Lassie, Old Yeller, and Ben.

The relationship of which I speak is, of course, your union with the student debt finance sector, a sprawling network with roots in the Student Loan Marketing Association, otherwise known as “Sallie Mae.” Sallie Mae was the first private company or “government-sponsored enterprise (GSE) empowered… to use U.S. Treasury money to buy government-backed student loans from banks.” Sallie Mae, “transitioned to a fully privatized bank lender between 1997 and 2004,” and per The Nation, “as the largest lender it now sets the trends and standards for the industry.”

Sallie Mae was the love child of Richard Nixon, banking and high finance. Mes amis, you might know a little bit about Nixon and something called “Watergate” from watching HBO’s The White House Plumbers. And if so, you know why his nickname was “Tricky Dickie.” And for those of you who didn’t see it, I’m asking you to please take your minds out of the gutter. Because Nixon was a Quaker–albeit, one who, if there were any justice in the world, would have been tried at Nuremberg alongside Henry Kissinger for war crimes in Viet Nam, Laos, and Cambodia, Chile, and East Timor. And that’s just for starters.

My point is that somewhere in the long list of Nixon’s dickiest tricks was his role in giving birth to Sallie Mae, putting this fine nation on the path to the predatory system we have today, one in which young people three years from being able to walk into a 7-11 and legally buy a pack of cigarettes or six-pack of beer, now routinely engage in a legit pre-frontal-lobe-coming-of-age ritual, signing off on documents and coerced into impossible decisions that will have critical implications for their long term financial, marital, reproductive, mental, and physical health.

I’m talking about a document that stands a pretty good chance of rendering you an indentured servant for a couple of decades. A contract you’d need an MBA in Finance–or a lawyer–to fully understand, one you understood so little you might as well have been drunk when you signed it. And some of you might have been if you could have just gotten that guy to buy beer for you again.

Who would suspect an institution called ‘Sallie Mae,’ an institution that sounds like a character from the Beverly Hillbillies, to behave in such a rankly predatory manner? If there were truth in advertising at all, Sallie Mae would be called “Maggie Mae” or “Mrs. Robinson,” and you would be called Rod Stewart or Jonathan, because you were a mere naïf when you signed on that dotted line, and had no way of understanding that for decades you’d have Sallie Mae rummaging around in your pockets.

Because, unlike virtually every other kind of debt in the U.S., student debt cannot be discharged through bankruptcy. For some of you, it be a ‘til-death-do-you-part relationship. You

“nontraditional,” aka older students, who returned to school for a second lease on life, might not have realized that if you’re unable to pay off on those loans in your old age while struggling to keep a roof overhead, the feds will happily step in to garnish your Social Security check and help kick you to the curb.

Bear with me while I wax lyrical about CEO pay and neoliberalism. First off: The difference between the very low interest rates that Sallie Mae and other GSEs pay, and the substantially higher interest you will pay if you’ve hooked up with them is what accounts for the fact that in 2021, the CEO of the GSE SoFi, made $103 million the same year he sued the Biden administration to force it to jump start student debt repayments.

The far higher interest rates GSEs charge borrowers explains why, for a long, long time, so many of you are poised to eat lots of freeze-dried Ramen noodles with just those shitty little flavor packets, while GSE CEOs chow down on Ramen seasoned with actual gold flakes–or maybe just expensive stuff with French names like “foie gras.”

“How is it,” you ask, in our imaginary Socratic dialogue, “that private corporations in the U.S. can make grotesque profits lending public money?” “Why,” you ask, “do we not simply eliminate the middleman and have the government lend money to students directly at the kind of minimal interest that Sallie Mae and Co. have long paid to the government? Or better yet, why not make higher education free, as it once was in this fine nation, and as it is today in at least 22 countries worldwide?”

I hope you don’t mind my saying that when you talk like that you remind me of your great granddad back in the 1930s, a man I never met, but I’m certain, nonetheless, was a fine man. One who, along with many of his generation, might well have spent considerable time agitating with his union for “the New Deal.” Because the host of protections The New Deal put in place for workers included a 40-hour work week, and Social Security, not to mention a robust supply of public housing that ensured that (albeit, mainly White) workers could negotiate with the boss from a stronger position. Public housing made it far less likely that striking workers would get thrown out in the street on their keisters while landlords and bosses did the Charleston whilst sucking down bathtub gin with Mary Pickford and Gloria Swanson.

When it comes to student debt, though, Trickie Dickie might have learned a trick of two from California governor (1967-75) Ronald Reagan. His campaign for governor centered on two deliverables: “’send[ing] ‘the welfare bums back to work,’ and ‘clean[ing] up the mess at Berkeley.’” And by the “mess at Berkeley,” Reagan meant organizing for racial and gendered justice, for labor and living wages, for free speech, and for an end to the slaughter and ecocide in Viet Nam. As the new sheriff in town–or governor, anyway–Reagan would break with Berkeley’s nearly 100-year tradition of tuition free education.

The star of such classics as Bedtime for Bonzo, and ironically, Bonzo goes to College, as I’ve written elsewhere in Counterpunch, “greased his personal path to the White House on the neoliberal snake oil of ‘Trickle Down Economics’ and Free Market Fundamentalism. Reagan would jump start the neoliberal bait and switch transfer of funds from public housing, education, and welfare, to policing, prisons, and endless war.” In the next few decades, states and the federal government radically scaled back taxes on the wealthy, invoked budget constraints (“austerity”) to justify undermining higher education, and increasingly recast it from a necessary foundation of a democratic society to STEM-based technocratic career training.

“Between 1980 and 2020, the average price of tuition, fees, and room and board for an undergraduate degree increased 169%.” The incremental corporatization and privatization of higher education meant prioritizing obscenely high administrative salaries over the wages, well-being, healthcare and job security of a whole host of academic workers. In the forty years since the Bonzo presidency, “the academic labor pool has shifted dramatically: 40 years ago, 70 percent of academic employees were tenured or on the tenure track. Today, that figure has flipped: 75 percent of faculty are not eligible for tenure.” The “47 percent [who] hold part-time positions” are themselves heavily burdened with student debt and struggling to stave off hunger and homelessness.

Republican Grover Norquist famously encapsulated neoliberal values, describing an ideal government as one that is “small enough to drown in a bathtub.” Neoliberalism, in other words, idealizes government stripped of regulatory capacity, where foxes and bipartisan corporate hucksters run amok eating chicken in the federal hen house. A government that lets rapacious capitalists get on with their daily business of extracting more wealth, driving us deeper and deeper into debt, deregulating us into a Dickensian world, albeit one with more cable channels.

A 2019 Hope Center survey of 167,000 students found that 41% of students at four year institutions …experienced food insecurity,” while “48% at four-year institutions experience housing insecurity.” And those who are emerging with decades of debt ahead of them stand a far greater chance of joining the ranks of the houseless.

What do we make of the fact that thousands of people now routinely die houseless every year in the U.S., no beds, no toilet, just bony backs on cement and the ever-present threat of campsite sweeps and criminalization for meeting the most human of needs: sleeping, shitting, and drawing breath?

Just how many people can we demonize as having made bad choices before we accept that the problem is the system itself and that the system endangers all our lives? How much cruelty are we willing to sanction and rationalize?

The fact is that little document you signed off on before you could legally smoke stands a good chance of negatively impacting your health in myriad ways. A 2021 “mental health survey of over 2,300 high debt student loan borrowers found that 1 in 14 respondents experienced [student loan-related] suicidal ideation at some point during their repayment journey.”

A 2013 study at Northwestern University demonstrated the obvious: debt has significant impacts on not just mental but physical health. Debt is “an important socioeconomic determinant of health” that, like smoking, raises blood pressure and negatively impacts cardiovascular health.

As a system, student debt fundamentally undermines family life: people with student debt are less likely to marry and have children than those without, and when they do have children (whether by choice or compulsion given the Supreme Court’s recently affirmation of the originalist Constitutional principle that every sperm is, in fact, sacred) they have far less time and money to spend with or on them.

According to 2021 data, “the average student borrower takes 20 years to pay off their student loan debt.” Now take a look at all the faces of the proud parents who are here with us today to help celebrate this milestone with you. I mean look really closely at their faces–because that, my dear young friends, is the age a good many of you will be by the time you finish paying off your student loans.

And that’s if you’re lucky, because, historic and ongoing patterns of discrimination in employment, housing, and healthcare mean that if you’re a White male, you stand a better chance than most to be able to wrap up payments on your debt soon enough to be able to save up a down payment on your second wedding or that red corvette you’re definitely going to need to soothe your inevitable midlife crisis.

Because if Thoreau did not number himself among the “masses of men [who] live lives of quiet desperation,” it was at least partly because he graduated university debt free and, was more or less living rent-free in the 19th century rustic equivalent of Ralph Waldo Emerson’s garage, albeit with fewer power tools.

If White guy student debt sounds bleak, White women and people of color don’t fare nearly as well. In fact: “Black college graduates owe an average of $25,000 more in student loan debt than White college graduates.” And “Four years after graduation, Black students owe an average of 188% more than White students borrowed.”

Because the debt picture looks a little different for folks whose great-granddads were shut out of a lot of the benefits of the New Deal, and also the GI Bill when they came home from World War II all spit and polish from fighting fascism abroad. Educational apartheid in the U.S. meant that BIPOC veterans, like White women veterans, were largely shut out of GI educational benefits, until the Black Power Movement of the late 1960s.

Similarly, Native American, Black, and Latinx G.I.’s, who fought against fascism in Europe, were shut out of VHA loans when they returned. And the effect was compounded by practices like redlining, racially restrictive real estate codes, eminent-domaining houses, ramming through highways in Black neighborhoods, urban “renewal” (via wrecking ball), predatory lending, and on and on. In 2020, Black Americans were 30% less likely than White Americans to own homes, and overall, “White Americans hold ten times more total wealth than Black Americans.”

The federal government doesn’t even keep data on wealth disparities among Native Americans.

And the entire “land grant” university system was built on the backs of Native communities, financed by the appropriation of more than 11 million acres of Indigenous land. Meanwhile, Native American students remain the most under-represented population at U.S. universities.

But when that long American tradition of colonialism and White supremacist fuckery is compounded by sexism, sexual violence, and reproductive injustice, we find (surprise, surprise!) that Black women are the most weighed down by debt. “Nearly two-thirds of the $1.7 trillion in student debt in America is held by women,” and “Black women graduate with $37,558 of student debt on average, compared to $22,000 owed by women overall and $18,880 owed by men overall.”

But for those of you who are yet unmoved, here’s the kicker: cancelling student debt would help just about all of us average working Joe and Janelle Q. American whether you’ve gone to college or not. Because studies have repeatedly demonstrated that just about every sector of society and the economy (aside from the super-rich) would benefit.

Rather than busting your asses for a few decades so that $1.7 trillion can accumulate interest and profit for CEOs at Sallie Mae and SoFi, bankroll Clarence and Ginny Thomas’ vacation, or get blown up in the hands of yet another billionaire in a particularly public and embarrassing act of premature space ejaculation, that money could go into rebuilding and revitalizing local economies.

Student debt cancellation would mean that $1.7 trillion could go instead to a new roof for the Martini family over there. Bert and Ernie here could finally quit their day jobs, hang out their contractor’s shingle, and splash out on the big wedding they’ve always wanted; and, like the Martini’s, George and Mary could finally afford to pay for birth control.

“But,” you might ask (if I would only stop droning on with my finely honed anecdotes and seemingly picaresque musings while you sit there stewing in your own sweat, sucking down forest fire) “what about the debt ceiling?” “Where,” you might ask yourself, was all the talk about the debt ceiling when Biden’s predecessor in the White House was ramming through tax cuts for the rich. And when he helped ram through the bipartisan so-called Paycheck Protection Program (PPP), which persisted into the Biden administration?

Of a total of $800 billion dollars in PPP loans dispersed, a whopping “91% [of the loans] have been fully or partially forgiven,” despite the fact that the program’s “own inspector general has estimated that at least 70,000 loans are potentially fraudulent,” and University of Texas researchers estimate the rate of fraud to be far higher.

In fact, some of the most windy critics of student loan forgiveness, including folks in Congress like Marjorie Taylor Greene and Matt Gaetz, who’ve seemed most willing to play chicken with the debt ceiling, most willing to make like Thelma and Louise by driving our Collective-All-American-God-Gun-and-Family-Loving-Financial-Station-Wagon off a steep cliff, have benefited from PPP loans that have also been forgiven, and are far in excess of the average American’s student debt.

And keep in mind that U.S. military expenditures are higher than the combined military budgets of China, India, Russia, the U.K., Saudi Arabia, Germany, France, Japan, and South Korea.

To put the problem in perspective, Brown University’s National Priorities Project estimates the total financial cost of the U.S. wars in the Middle East since 2001 at $8.04 trillion, or nearly 5 times the full $1.7 trillion in student debt owed.

The total human cost of all that liberation, according to the Brown University Costs of War Project, includes the lives of 7057 Americans killed in the war; an additional 30,177 American service people lost to suicide; an estimated 387,073 civilians in the Middle East and Pakistan killed directly by bullets, bombs, drones, etc.; and millions more dead from “battered infrastructure and poor health conditions arising from the war,” malnutrition, etc.

In the Beyond Vietnam speech that likely got Martin Luther King killed, he spoke of the war in Vietnam as “a demonic destructive suction tube” that “draws men and skills and money,” leaving the 1960s dream of Lyndon B. Johnson’s “Great Society” and the “War on Poverty,” “broken and eviscerated, as if it were some idle political plaything of a society gone mad on war.”

Today just a 10% cut in the U.S. military budget is enough to cover “2.46 million Scholarships for University Students for 4 Years, or” for that matter, “10.95 million Public Housing Units for 1 Year.” In other words, U.S. imperialism is why we can’t have nice things.

Neoliberal claims (from both Democrats and Republicans) about the benefits and added efficiency of winnowed back government, about the magic of “public and private partnerships,”

deregulation and the gutting of the social safety net, and the dismantling of living wage, union jobs has never been anything but smoke and mirrors, a government disappearing act–except, of course, when it comes to bombs, bullets, prisons, border fences.

And by the by, the fresh air you’re smelling right now is the smell of ancient arboreal forests going up in flames. It’s the smell of your future–of your children’s and grandchildren’s futures– burning. So, on your way out of the auditorium today, please do be sure to sign off on Milgram State’s vibrant fossil fuel divestment campaign. Because I think you’ll agree that we have no business investing in corporations whose daily operations erode our ability to deliver to our students, our children, and our grandchildren, the livable planet and functional democracy they have every right–if not every expectation–to inherit. And that, my friends, ought to go also for the likes of Sallie Mae and friends.

Rob Nixon, the author of Slow Violence and the Environmentalism of the Poor, described the climate crisis as “a kind of intergenerational theft of the conditions of life itself.” How can we possibly justify leaving your generation with not only a depleted planet in crisis but also with levels of educational debt that have no historical precedent?

How can we, as educators, who swear by the principle of informed consent in our research, remain silent in the face of a system that forces our students to make an impossible choice between education and decades of debt?

Whatever the outcome of the Supreme Court decision on student debt cancellation, let’s commit ourselves today to organize together, to explore new ways of re-forming universities to center community–rather than corporate–needs. Let’s break the silence about debt and debt resistance. Let’s center food sovereignty and resilience, water, climate justice, #landback, reparations, and diversity in all its forms. Let’s commit to centering the arts and humanities, without which we have no capacity to know the past or imagine and create an alternative future.

I leave you with free copies of The Debt Resister’s Manual, and with the words of Arundhati Roy: “The corporate revolution will collapse if we refuse to buy what they are selling – their ideas, their version of history, their wars, their weapons, their notion of inevitability.

Remember this: We be many and they be few. They need us more than we need them.

Another world is not only possible, she is on her way. On a quiet day, I can hear her breathing.”

NOTES

1. The “high” here metaphorical unless you’re talking about “powder” cocaine, “blow” and “nose candy”) in which case the word is used both literally and metaphorically. ↑

This content originally appeared on CounterPunch.org and was authored by Desiree Hellegers.

Desiree Hellegers | Radio Free (2023-06-16T05:57:47+00:00) My (Imaginary) Commencement Address. Retrieved from https://www.radiofree.org/2023/06/16/my-imaginary-commencement-address/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.