As the hack-and-slash crusade of the “Department of Government Efficiency” picked up steam in early February, the Washington Post editorial board (2/7/25) gave President Donald Trump a tip on how to most effectively harness Elon Musk’s experience in “relentlessly innovating and constantly cutting costs”: Don’t just cut “low-hanging fruit,” but “reform entitlement programs such as Social Security and Medicare before they become insolvent.”

Repeating the “flat Earth–type lie” of looming Social Security insolvency (Beat the Press, 5/8/24) has been a longtime hobby horse of corporate media, as has been reported at FAIR (e.g., 1/88, 6/25/19, 6/15/23) and elsewhere (Column, 8/4/23). While many leading newspapers have rightly called out Musk’s interventions into Social Security and the rest of the administrative state, they still push the pernicious myth that the widely popular social program is struggling and nearing insolvency, with few viable options for its rescue.

‘If nothing changes’

The Washington Post (5/6/24) last year depicted Social Security as literally throwing money down a hole.

An AP report (2/27/25) on Musk’s staffing cuts at the Social Security Administration, published in and then later taken down from the Washington Post (2/27/25), mentioned that “the program faces a looming bankruptcy date if it is not addressed by Congress.” It claimed that Social Security “will be unable to pay full benefits beginning in 2035.” The New York Times (3/5/25) concurred that the program is “in such dire financial trouble that benefit cuts could come within a decade if nothing changes.”

Such sky-is-falling reporting didn’t start with DOGE’s entry on the scene (e.g., New York Times, 1/26/86, 12/2/06; Washington Post, 11/8/80, 5/12/09). Indeed, the Post was beating this drum loudly after the 2024 Report of the Social Security Trustees was released last May. “Financial reality, though, is that if the programs aren’t reformed, and run out of money to pay required benefits, cuts could become unavoidable,” the Post editorial board (5/6/24) lamented.

These arguments misrepresent the structure of Social Security. In general, Social Security operates as a “pay-as-you-go” system, where taxes on today’s workers fund benefits for today’s retirees. While this system is more resilient to financial downturn, it “can run into problems when demographic fluctuations raise the ratio of beneficiaries to covered workers” (Economic Policy Institute, 8/6/10). During the 1980s, to head off the glut of Baby Boomer retirements, the Social Security program raised revenues and cut benefits to build up a trust fund for surplus revenues.

It’s worth noting that by setting up this fund, President Ronald Reagan helped to finance massive reductions in tax rates for the wealthy. By building up huge surpluses that the SSA was then required by law to pour into Treasury bonds, Reagan could defer the need to raise revenues into the future, when the SSA would begin tapping into the trust fund.

As US demographics have shifted, with Boomers comfortably into their retirement years, the program no longer runs a surplus. Instead, the SSA makes up the difference between tax receipts and Social Security payments by dipping into the trust fund, as was designed. What would hypothetically go bankrupt in 2035 is not the Social Security program itself, but the trust fund. If this were to happen, the SSA would still operate the program, paying out entitlements at a prorated level of 83%, all from tax receipts.

In other words, a non-original part of the Social Security program may sunset in 2035. While this could present funding challenges, it is not the same as the entire program collapsing, or becoming insolvent.

Furthermore, the idea that a crisis is looming rests on nothing changing in Social Security’s funding structure. Luckily, Congress has ten years to come up with a solution to the Social Security shortfall. We aren’t fretting today about how to fund the Forest Service’s army of seasonal trail workers for the summer of 2035. There’s no need to lose sleep over Social Security funding, either. As economist Dean Baker (Beat the Press, 5/8/24) put it:

There is no economic reason that we can’t pay benefits into the indefinite future, as long as we don’t face some sort of economic collapse from something like nuclear war or a climate disaster.

The easy and popular option is not an option

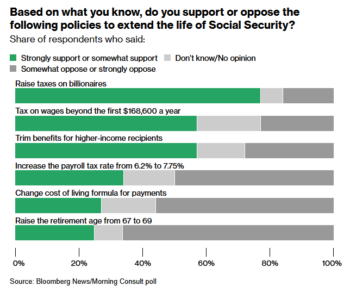

A Bloomberg/Morning Consult poll (4/24/24) of swing state voters found 77% in favor of raising taxes on billionaires to aid Social Security.

There are three main solutions that can be found in stories about Social Security’s woes. In the wake of last year’s Trustees’ Report, the Washington Post (5/6/24) listed “the politically treacherous choices of raising the payroll tax, cutting benefits…or taking on more public debt to prop up the system.” The first two options increase the burden on workers, either by raising their taxes, or cutting benefits that they are entitled to, and have already begun paying into. The third option, taking on more public debt, is no doubt a nonstarter for the deficit hawks at the Post.

But this explainer-style news piece, titled “The US Has Updated Its Social Security Estimates. Here’s What You Need to Know,” neglected to mention the easiest and most popular option: raising the cap on income from which Social Security taxes are withheld.

In 2025, income up to $176,100 is taxed for Social Security purposes. Anything beyond that is not. In other words, the architect making close to 200 grand a year pays the same amount into Social Security as the chief executive who takes home seven figures. One simple, and popular, way to increase funding for Social Security is to raise that regressive cap.

To be fair to the Post, the cap increase has been mentioned elsewhere in its pages, including in an opinion piece (5/6/24) by the editorial board published that same day. However, despite acknowledging that “many Americans support the idea” of raising the limit, the editorial board lumps this idea in with “raising the retirement age for younger generations and slowing benefit growth for the top half of earners,” before concluding that “these [solutions] won’t be popular or painless.”

Raising the cap on income is, in fact, popular (as the Post editorial board itself acknowledged), and the only pain it would cause is for the top 6% of income-earners who take home more than $176,100. The New York Times (3/5/25) also mentions a cap increase as an idea to “stabilize” the program, only to say that “no one on Capitol Hill is talking seriously about raising that cap any time soon.” Why that is the case is left unsaid.

Even more popular than raising the cap on wages was President Joe Biden’s proposed billionaires tax, which “would place a 25% levy on households worth more than $100 million. The plan taxes accumulated wealth, so it ends up hitting money that often goes untaxed under current laws” (Bloomberg, 4/24/24). Perhaps unsurprisingly, this kind of solution was not explored in the Times, nor in the billionaire-owned Post.

Useful misinformation

Reports of Social Security’s impending demise are greatly exaggerated. As economist Paul Van De Water wrote for the Center on Budget and Policy Priorities (7/24/24):

Those who claim that Social Security won’t be around at all when today’s young adults retire and that young workers will receive no benefits either misunderstand or misrepresent the trustees’ projections.

Social Security’s imminent demise may not be true, but it’s very useful to those who want to rob all the workers who have dutifully paid their Social Security taxes, by misleading them into thinking it’s simply not possible to pay them back what they’re owed when they retire.

Compared to the retirement programs of global peers, the United States forces its workers to retire later, gives retirees fewer benefits and taxes its citizens more regressively (Washington Post, 7/19/24). Despite this, Americans still love Social Security, and want the government to spend money on it. Far from cuts called for by anxious columnists, the only overhaul Social Security needs is better benefits and a fairer tax system.

This content originally appeared on FAIR and was authored by Paul Hedreen.

Paul Hedreen | Radio Free (2025-03-21T19:48:08+00:00) Decades of Media Myths Made Social Security Vulnerable to Political Attack. Retrieved from https://www.radiofree.org/2025/03/21/decades-of-media-myths-made-social-security-vulnerable-to-political-attack/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.